Cost Allocation Bill

Last updated:2024-12-02 17:46:26

Overview

Cost allocation means users' redistribution of fees or costs of cloud resources in their bills based on their own management or analysis needs. A cost allocation bill is a bill with finer granularity after redistribution.

Tencent Cloud achieves cost allocation by setting cost allocation units and cost allocation tags. For the setting of cost allocation units and cost allocation tags, see the documentation of Cost Allocation Units and Cost Allocation Tags.

Description of Cost Allocation Bill Features

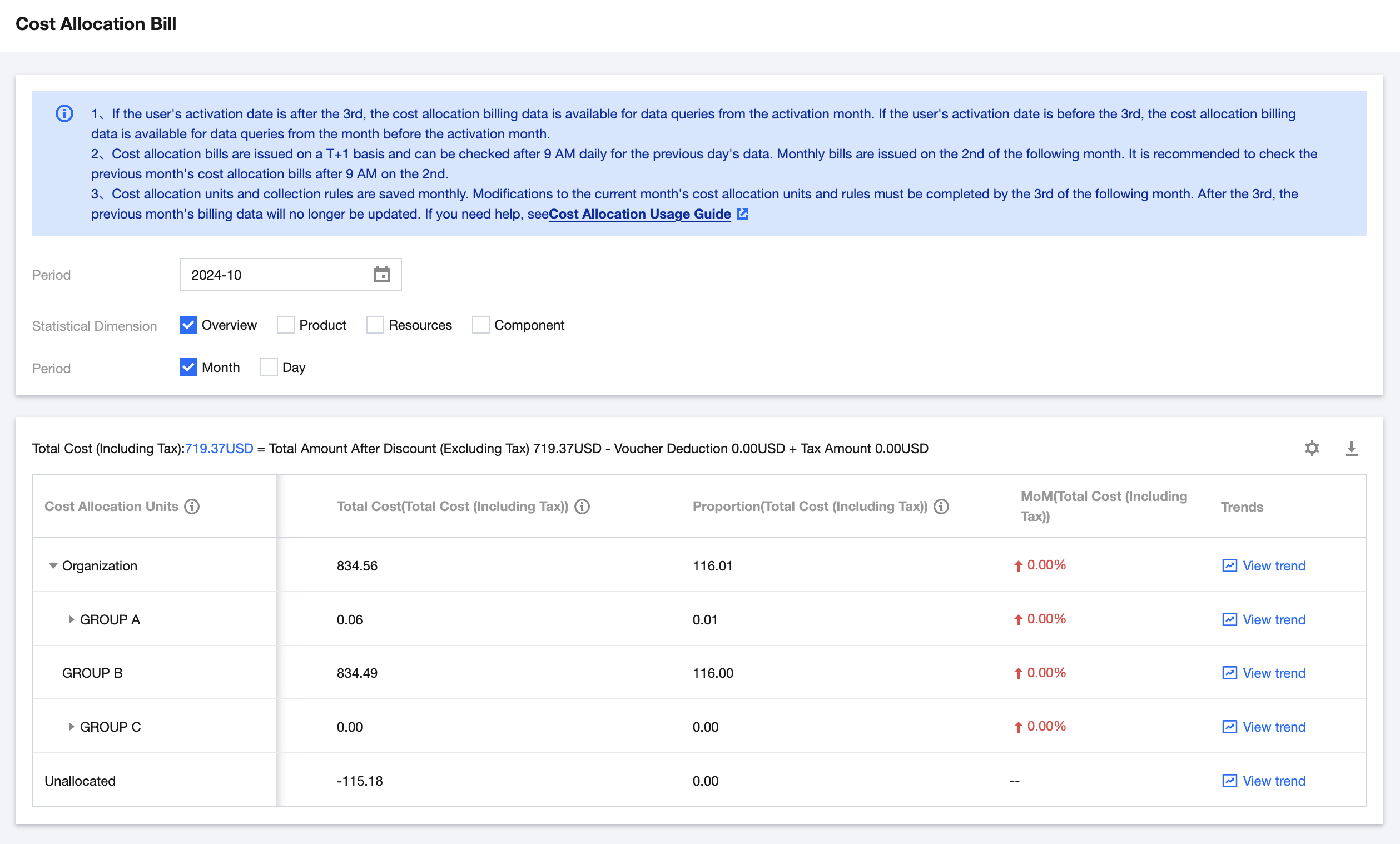

A cost allocation bill includes detailed expenses of all cost allocation units, and can clearly show the cloud resource usage and expense proportion of each department or project. Through the cost allocation bill, enterprises can more accurately understand the cloud resource usage of each department or project, so as to better control the budget and cost. You can choose the billing period, statistical dimension, and statistical period of the cost allocation bill as needed, and view the cost allocation bill.

The cost allocation bill shows statistical cost allocation results through Overview, Product, Resources, and Component dimensions, and the statistical period supports Month and Day dimensions.

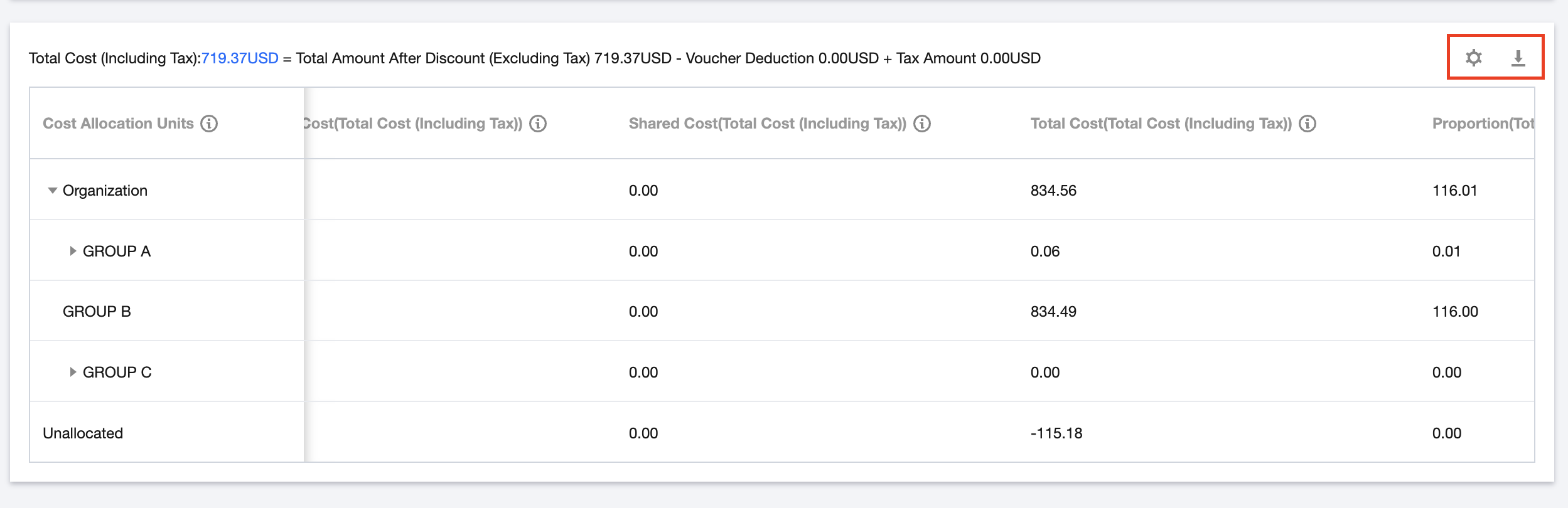

It supports viewing collected costs, shared costs, and total costs separately.

It supports viewing the Proportion, MoM , and Trend of costs.

Notes:

If the user's activation date is after the 3rd, the cost allocation billing data is available for data queries from the activation month. If the user's activation date is before the 3rd, the cost allocation billing data is available for data queries from the month before the activation month.

Cost allocation bills are issued on a T+1 basis and can be checked after 9 AM daily for the previous day's data. Monthly bills are issued on the 2nd of the following month. It is recommended to check the previous month's cost allocation bills after 9 AM on the 2nd.

Cost allocation units and collection rules are saved monthly. Modifications to the current month's cost allocation units and rules must be completed by the 3rd day of the following month. After the 3rd, the previous month's billing data will no longer be updated.

Directions

1. Log in to the Billing Center console.

2. In the left sidebar, select Cost Allocation Management > Cost Allocation Bill .

3. Select the data range you need to query: Period, Statistical Dimension, and Statistical Period.

4. Click Custom Field Settings , tick the fields you want to view, untick the fields you do not want to view, and then click Save .

5. Click Export to go to the Download Records page to download the file.

Field Description

Field Name | Field Description |

Cost Allocation Unit | The name of the organizational unit set by the customer for cost allocation. |

Cost Allocation Type | Cost source types: shared, collected, and unallocated. |

Date | Settlement date. |

Payer Account ID | The account ID of a payer, which is the unique identifier of a Tencent Cloud user. |

Owner Account ID | The account ID of an actual resource user. |

Operator Account ID | The account ID of an operator (the ID or role ID of the resource account activated by pre-paid resource ordering or pay-as-you-go operation). |

Billing Mode | The billing mode of resources, which can be monthly subscription or pay-as-you-go billing. |

Transaction Type | Detailed transaction type. |

Order ID | The ID of the order in the monthly subscription mode. |

Transaction ID | The ID of the settlement fee deduction transaction. |

Transaction Time | The time of the settlement fee deduction transaction. |

Usage Start Time | The time at which product or service usage starts. |

Usage End Time | The time at which product or service usage ends. |

Product Name | The name of a Tencent Cloud product purchased by the user, such as CVM. |

Subproduct Name | The subcategory of a Tencent Cloud product purchased by the user, such as CVM – Standard S1. |

Region | The region to which a resource belongs, such as South China (Guangzhou). |

Availability Zone | The availability zone to which a resource belongs, such as Guangzhou Zone 3. |

Instance ID | The instance ID of a billed resource. It may vary due to various forms and contents of resources in different products. For example, CVM is the corresponding instance ID, while COS is the corresponding bucket ID. |

Configuration Description | The name and corresponding usage (total usage for a component billed by cumulative usage) of each component under a resource displayed in a resource bill. |

Component Configuration | The information on various configuration specifications displayed in the detailed bill. |

Instance Name | The resource name set by the user in the console. If not set, it will be empty by default. |

Instance Type | The instance type of a product or service purchased, which can be resource package, RI, SP, or spot instance. "-" is shown by default for regular instances. |

Tag Key1-N | All tags bound to a resource. |

Tag Key: xxx | |

Project name | The project to which a resource belongs. The user assigns a resource to a project in the console. If a resource has not been assigned to a project, it will automatically belong to the default project. |

Component Type | The component type of a product or service purchased by the user. |

Component Name | The specific component of a product or service purchased by the user. |

Component List Price | The original unit price of a component on the official website (if the customer enjoys a fixed price/contract price, it is not displayed by default). |

Component Contracted Price | The contracted unit price of a component, which is list price x discount. |

Component Price Measurement Unit | The unit of measurement for a component price, which is composed of USD, usage unit, and duration unit. |

Component Usage | The actual usage of a component. Component Usage = Original Component Usage - Deductible Usage (including Resource Packages). |

Component Usage Unit | The unit of measurement for component usage. |

Usage Duration | The duration of resource usage. Usage Duration = Original Component Usage Duration - Deductible Duration (including Resource Packages). |

Duration Unit. | The unit of measurement for resource usage duration. |

Additional Attribute | Other remarks, such as the instance type and transaction type of a reserved instance (for example: s1.18px, One-off RI fee) or regional information on both ends of CCN product (for example: Shanghai - Beijing). |

RI Deduction (Duration) | The usage duration deducted from a reserved instance used for this product or service. |

RI Deduction (Cost)(USD) | The original component price deducted from a reserved instance used for this product or service. |

SP Deduction | The savings plan deduction amount. |

SP Deduction Rate | The discount multiplier that applies to the component based on the remaining commitment of the savings plan. |

SP Deduction (Cost)(USD) | SP Deduction(Cost)(USD) = SP Deduction/SP Deduction Rate. |

Discount Multiplier | The discount multiplier enjoyed by this resource (if the customer enjoys a fixed price/contract price, it is not displayed by default, and also not displayed in refund scenarios by default). |

Blended Discount Multiplier | The final discount multiplier after various discount deductions are applied. Blended Discount Multiplier = Total Amount After Discount/Original Cost. |

Total Amount After Discount (Excluding Tax) | Total Amount After Discount (Excluding Tax) = [Original Cost - RI Deduction (Cost) - SP Deduction (Cost)] * Discount Multiplier. |

Voucher Deduction(USD) | The amount paid with various vouchers (such as promo vouchers and cash vouchers). |

Amount Before Tax | Pretax amount after voucher deduction. |

Tax Rate | Tax rate. |

Tax Amount | Tax amount. |

Currency | The currency used for the settlement of a component. |

Product Code | The code corresponding to the Product Name field. |

Subproduct Code | The code corresponding to the Subproduct Name field. |

Component Type Code | The code corresponding to the Component Type field. |

Component Code | The code corresponding to the Component Name field. |

Bill Month | It is used to record the bill month, such as 2024-01. |

Region ID | The ID corresponding to the Region field. |

Availability Zone ID | The ID corresponding to the Availability Zone field. |

Discount Object | The discount object for the current consumption item, such as official website discount, user discount, or event discount. |

Discount Type | The discount type for the current consumption item, such as discount or contract price. |

Discount Content | A supplementary description of the Discount Type, such as 20% business discount which indicates that the Discount Type is "Discount" and the Discount Content is "0.8". |

Total Cost (Including Tax) | Total resource cost (including tax) after discount, which is Original Component Cost x Discount Multiplier x (1 + Tax Rate), or Component Unit Price x Usage x Usage Duration x (1 + Tax Rate). |

Original Cost(USD) | Original Cost = Component List Price x Component Usage x Usage Duration (if the customer enjoys a fixed price or contract price, it is not displayed by default, and also not displayed in refund scenarios by default). |

Price Attribute | Attribute information impacting discount pricing for this component, excluding unit price and duration. |

Original Usage/Duration | Original component usage/duration before deduction by resource packages (Currently, only TRTC, TEM, Cloud Contact Center, and CDZ products support this information display. Other products are still being integrated.). |

Deductible Usage/Duration (including Resource Packages) | Component usage/duration deducted by resource packages (Currently, only TRTC, TEM, Cloud Contact Center, and CDZ products support this information display. Other products are still being integrated.). |

Calculation Description | A detailed billing and settlement calculation description for special transaction types, including refunds and configuration adjustment. |

Billing Rule | Official website link for detailed billing rules for each product. |

Associated Transaction Document ID | Associated document ID for this transaction, such as the original new purchase order corresponding to the refund order. |

Collected Cost(Total Amount After Discount (Excluding Tax)) | The total amount after discount (excluding tax) directly collected to the cost allocation unit based on collection rules. |

Shared Cost(Total Amount After Discount (Excluding Tax)) | The total amount after discount (excluding tax) shared to the cost allocation unit based on sharing rules. |

Total Cost(Total Amount After Discount (Excluding Tax)) | Total Cost (Total Amount After Discount (Excluding Tax)) = Collected Cost (Total Amount After Discount (Excluding Tax)) + Shared Cost (Total Amount After Discount (Excluding Tax)). |

Collected Cost(Voucher) | The voucher directly collected to the cost allocation unit based on collection rules. |

Shared Cost(Voucher) | The voucher shared to the cost allocation unit based on sharing rules. |

Total Cost(Voucher) | Total Cost (Voucher) = Collected Cost (Voucher) + Shared Cost (Voucher). |

Collected Cost(Total Cost (Including Tax)) | The total cost (including tax) directly collected to the cost allocation unit based on collection rules. |

Shared Cost(Total Cost (Including Tax)) | The total cost (including tax) shared to the cost allocation unit based on sharing rules. |

Total Cost(Total Cost (Including Tax)) | Total Cost (Total Cost (Including Tax)) = Collected Cost (Total Cost (Including Tax)) + Shared Cost (Total Cost (Including Tax)). |

Collected Cost(Tax Amount) | The tax amount directly collected to the cost allocation unit based on collection rules. |

Shared Cost(Tax Amount) | The tax amount shared to the cost allocation unit based on sharing rules. |

Total Cost(Tax Amount) | Total Cost (Tax Amount) = Collected Cost (Tax Amount) + Shared Cost (Tax Amount). |

Proportion(Total Cost (Including Tax)) | Total Cost (Total Cost (Including Tax)) of This Cost Allocation Unit/Total Cost (Total Cost (Including Tax)) * 100%. |

MoM(Total Cost (Including Tax)) | [Total Cost (Total Cost (Including Tax)) of This Cost Allocation Unit for the Current Month - Total Cost (Total Cost (Including Tax)) of This Cost Allocation Unit for the Previous Month]/Total Cost (Total Cost (Including Tax)) of This Cost Allocation Unit for the Previous Month * 100%. |

Was this page helpful?

You can also Contact Sales or Submit a Ticket for help.

Yes

No

Feedback